Utilize Your Home's Worth: The Benefits of an Equity Financing

When considering financial alternatives, leveraging your home's value through an equity car loan can offer a critical approach to accessing added funds. From adaptability in fund usage to potential tax benefits, equity car loans offer an opportunity worth exploring for homeowners seeking to optimize their monetary sources.

Advantages of Equity Car Loans

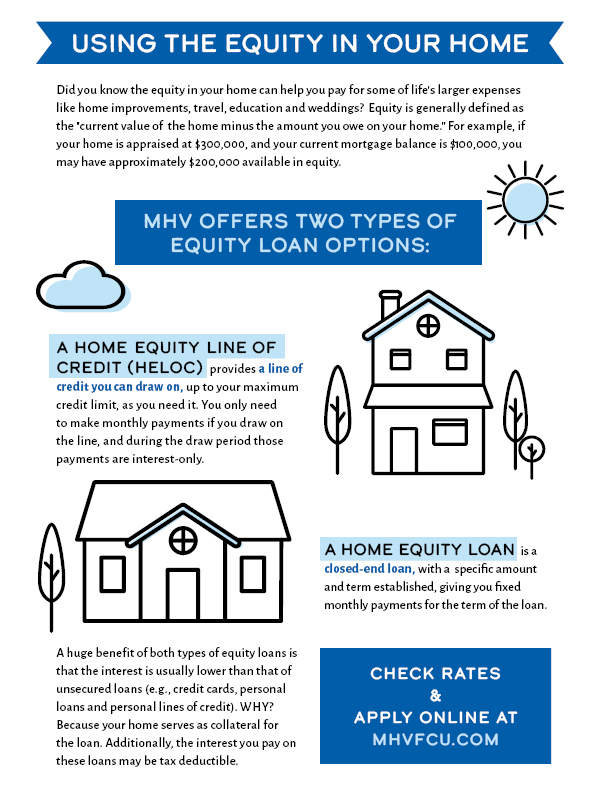

One of the primary advantages of an equity finance is the ability to access a huge amount of money based on the value of your home. This can be particularly advantageous for homeowners that require a significant quantity of funds for a particular purpose, such as home renovations, financial debt combination, or major costs like clinical expenses or education prices. Unlike other kinds of loans, an equity car loan commonly offers reduced rate of interest rates due to the collateral supplied by the building, making it a cost-effective borrowing alternative for many people.

Moreover, equity car loans commonly provide much more versatility in terms of settlement timetables and funding terms contrasted to various other forms of financing. In general, the capability to accessibility significant sums of money at lower rate of interest prices with adaptable repayment options makes equity finances a valuable financial tool for home owners seeking to take advantage of their home's value.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

Flexibility in Fund Use

Offered the useful loaning terms related to equity loans, homeowners can effectively utilize the flexibility in fund use to fulfill numerous economic requirements and objectives. Equity fundings supply house owners with the flexibility to utilize the borrowed funds for a large range of objectives. Whether it's home restorations, financial obligation combination, education expenditures, or unforeseen medical bills, the adaptability of equity financings permits people to address their financial requirements successfully.

One secret benefit of equity loans is the lack of limitations on fund use. Unlike some various other types of loans that define exactly how the obtained cash should be invested, equity fundings provide borrowers the freedom to allot the funds as required. This flexibility makes it possible for house owners to adapt the lending to match their distinct conditions and priorities. Whether it's purchasing a new service venture, covering emergency situation expenses, or funding a significant purchase, equity car loans encourage house owners to make strategic economic decisions lined up with their objectives.

Prospective Tax Advantages

With equity lendings, house owners might profit from potential tax benefits that can assist maximize their financial planning methods. One of the main tax advantages of an equity loan is the capability to subtract the interest paid on the finance in particular situations. In the United States, for instance, passion on home equity loans as much as $100,000 may be tax-deductible if the funds are utilized to enhance the property protecting the finance. This reduction can result in considerable cost savings for eligible property owners, making equity fundings a tax-efficient means to accessibility funds for home restorations or various other qualified costs.

Additionally, making use of an equity funding to consolidate high-interest financial debt may also cause tax advantages. By settling charge card financial obligation or other finances with higher rate of interest using an equity finance, property owners may be able to subtract the rate of interest on the equity lending, possibly saving much more money on taxes. It's essential for home owners to seek advice from a tax obligation consultant to recognize the certain tax implications of an equity financing based on their specific situations.

Lower Rates Of Interest

When discovering the economic advantages of equity financings, another key element to take into consideration is the potential for property owners to safeguard reduced rates of interest - Home Equity Loans. Equity finances often provide reduced passion prices compared to other kinds of loaning, such as individual car loans or credit scores cards. This is since equity financings are secured by the value of your home, making them less risky for loan providers

Reduced interest rates can result in significant expense financial savings over the life of the lending. Even a small portion distinction in passion rates can equate to substantial financial savings in interest settlements. House owners can make use of these financial savings to pay off the car loan quicker, build equity in their homes much more rapidly, or buy other locations of their economic profile.

In addition, reduced rates of interest can boost the total price of loaning against home equity - Alpine Credits. With lowered passion expenditures, home owners might discover it much easier to manage their regular monthly payments and maintain financial security. By taking benefit of reduced rates of interest through an equity lending, property owners can leverage their home's value better to fulfill their economic goals

Faster Access to Funds

Homeowners can quicken the procedure of accessing funds by utilizing an equity lending secured by the worth of their home. Unlike various other finance choices that may involve lengthy authorization procedures, equity finances supply a quicker path to obtaining funds. The equity accumulated in a home works check it out as security, providing loan providers higher confidence in extending credit scores, which improves the approval procedure.

With equity finances, property owners can access funds quickly, frequently obtaining the cash in a matter of weeks. This quick access to funds can be crucial in scenarios requiring prompt financial assistance, such as home remodellings, clinical emergencies, or financial obligation consolidation. Alpine Credits Home Equity Loans. By using their home's equity, house owners can swiftly attend to pressing monetary needs without extended waiting durations generally related to other kinds of lendings

In addition, the streamlined process of equity finances translates to quicker disbursement of funds, making it possible for property owners to confiscate timely investment chances or handle unexpected expenditures efficiently. In general, the expedited accessibility to funds via equity fundings emphasizes their practicality and ease for homeowners seeking punctual financial services.

Verdict

Unlike some various other kinds of fundings that specify exactly how the borrowed cash needs to be invested, equity finances use debtors the autonomy to assign the funds as needed. One of the primary tax benefits of an equity car loan is the ability to deduct the passion paid on the financing in particular circumstances. In the United States, for instance, interest on home equity lendings up to $100,000 might be tax-deductible if the funds are utilized to improve the building safeguarding the finance (Equity Loans). By paying off credit history card debt or various other financings with higher passion rates using an equity loan, house owners may be able to subtract the passion on the equity finance, potentially conserving even more cash on tax obligations. Unlike other lending alternatives that might include lengthy authorization treatments, equity car loans supply a quicker route to getting funds